The glossary we use to categorize startups typically refers to the industry in which a company operates. For instance, when we mention Insurtech or Healthtech, we immediately associate them with the insurance and healthcare sectors. However, among this array of terms, one stands out for not being tied to a specific operational vertical: Deeptech.

The definition of deeptech is not universally agreed upon, but there is consensus that a company qualifies as deeptech if it develops solutions based on significant scientific or technological advancements, tackles complex engineering challenges, and requires extensive research—hence its strong ties to the academic system.

For example, the ISDI business school defines deeptech startups as a new category of companies that distinguish themselves by their ambition to solve major problems, regardless of industry, using advanced scientific or technological breakthroughs.

On the other hand, some perspectives restrict deeptech to companies originating from science, technology, or engineering, focusing on pioneering knowledge and technology. These companies are often founded by individuals from universities and research institutions. Some even argue that deeptech firms only develop physical products (rather than digital services) and generally have a higher scalability potential than conventional startups.

As you can see, the term is open to debate.

Another widely accepted aspect is that, unlike conventional startups, deeptech companies have traditionally required significant capital investment before achieving commercial success. However, this might change as AI and language models become more of a commodity.

The broad definition and scope of deeptech make mapping and tracking these companies more challenging. To give well-known examples, OpenAI could be considered a deeptech company due to groundbreaking innovations like ChatGPT—though some may disagree since it’s not a physical product. Similarly, Zeleros Hyperloop, a Valencian company developing supersonic vehicles for intercity transport, also fits the deeptech category.

The current state of deeptech in the startup sector

According to a report by El Referente, Spain has approximately 1,210 deeptech spin-offs. These companies primarily emerge from universities and research centers, with a strong presence in biotechnology, artificial intelligence, advanced materials, and quantum computing.

The report estimates the annual revenue of Spanish deeptech companies at €2 billion, with their activity concentrated in Healthcare (35.5%), followed by ICT (16.9%), Industry 4.0 and Sustainability (12.4% each), and Agriculture (6.4%) as the most relevant sectors.

However, the main challenge remains access to funding, a critical barrier given that deeptech startups have longer development cycles and require much more capital in early stages compared to conventional startups.

This is likely why Spain lags behind other European countries in the number of deeptech companies, despite having highly competitive research talent and a strong academic network.

This is supported by another comprehensive study, the ‘State of European Tech’, which dedicates several chapters to the deeptech sector and has been previously analyzed from a global perspective in our content. Regarding deeptech specifically, the report indicates that while Spain is making progress, it still lags behind leading countries such as France, Germany, and the United Kingdom.

One example illustrating this gap is the Deep Tech Finder, a search tool developed by the European Patent Office. This tool is highly selective, listing only deeptech companies that have applied for European patents. It provides insight into the volume of deeptech firms in Spain and the rest of Europe. In the Valencian Community, it identifies 19 companies, with 17 based in Valencia.

Additional deeptech initiatives in Valencia include the Deeptech Workgroup by Startup Valencia, the UPV and Navantia Chair, focused on photonics and deeptech technologies.

Deeptech in Valencia: A strategy to foster deeptech companies

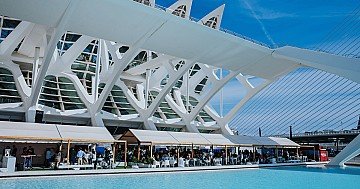

VDS has become a key event for the deeptech ecosystem. Since its inception, it has provided a platform for deeptech companies and speakers, and it will continue to do so in its upcoming 8th edition on October 22-23. The event, held at the City of Arts and Sciences in Valencia, will gather over 12,000 professionals from 120 countries, 3,000+ startups, 1,500+ corporations, and 800 investors managing assets exceeding €300 billion.

Among the deeptech-related technologies that will play a significant role at this year’s event are Cybersecurity, Nanotechnology, Photonics, Quantum, VR/AR, and, of course, everything related to Artificial Intelligence and Machine Learning. Particularly in use cases with an impact on Sustainability, Talent, Future Cities, and Health & Consumer Technologies.

“Our strategy to foster the creation and growth of deeptech companies in our ecosystem is based on two pillars: knowledge transfer and investment access,” explains Nacho Mas, CEO of Startup Valencia.

“Large corporations have traditionally innovated internally, within their own labs. But now, we see increasing collaboration between entrepreneurs, startups, spin-offs, and major companies. At the same time, international tech events like VDS bring together key players, investors, and global leaders to create synergies, foster business connections, and drive open innovation,” he adds.

It is important to note that the nature of a deeptech startup differs from the traditional “Minimum Viable Product → Market Fit → Scalability → Exit” roadmap. Deeptech startups face long development cycles, substantial initial investments, and significantly higher technical risks compared to other, less disruptive tech companies. This is why cross-sector collaboration, knowledge transfer, and early-stage investment access are crucial for their success.

As Startup Valencia’s CEO recently stated in Emprendedores magazine, “Valencia’s tech sector stands out in Spain for its strong culture of collaboration among startups, investors, corporations, universities, and public institutions. There is a cooperative spirit that accelerates startup growth. Accelerators, incubators, corporates, institutions, and venture capital funds have supported numerous startups, while international tech events like VDS position Valencia as a key innovation hub. Additionally, universities like UPV and UV play a fundamental role in connecting young talent with industry, fostering tech and scientific entrepreneurship, and training 3,500 new engineers annually.”

Some deeptech startups and companies in Valencia’s tech ecosystem

SCALE Nanotech – Nanotechnology solutions for optoelectronics and photonics

Zeleros Hyperloop – Developing a hyperloop-based sustainable transport system

Igenomix – Specializing in genetic diagnostics and personalized medicine

Kerionics – Developing ceramic membranes for industrial oxygen production

Rotary Wave – Advanced mechanical transmission technology for energy efficiency

Safe Load Testing – Industrial packaging validation solutions using advanced simulation

Mysphera – IoT technology for patient tracking in hospitals

Arthex Biotech – Gene therapies for rare muscle diseases

Bionos Biotech – Bioassay research for cosmetics and pharmaceuticals

Ingelia – Transforming organic waste into biochar and bioenergy

Quibim – AI-driven imaging diagnostics for healthcare

Tetraneuron – Developing treatments for neurodegenerative diseases like Alzheimer’s

Thalictrum Global Health – Biotechnology solutions for health and wellness

Optimus Garden – Smart vertical farming systems for sustainable food production

Nespra – IoT solutions for infrastructure and industrial monitoring

Elewit – A tech subsidiary of Red Eléctrica de España, focused on energy innovation

Certainly, there are many more deeptech companies in Valencia’s startup ecosystem. But given the lack of a universally accepted deeptech definition, the focus shouldn’t be on who makes the list—it should be on continued collaboration and funding to drive the sector forward.