RPX Gold Inc. (“RPX Gold” or the “Company”) (TSXV: RPX) is pleased to announce the results of a Preliminary Economic Assessment (“PEA”) for its 100%-owned Wawa Gold Project (the “Project”) located in northwestern Ontario, Canada. The PEA was prepared by DRA Americas Inc. (“DRA”), in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). All amounts are in Canadian dollars, unless otherwise stated.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260218160367/en/

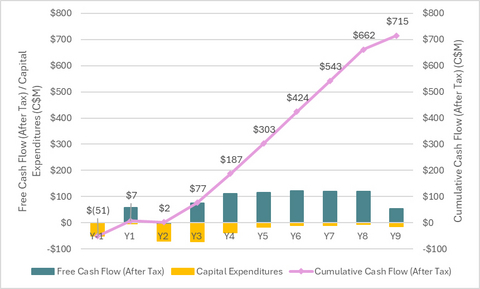

Figure-01: After-Tax Free Cash Flow Profile at US$3,500 Gold

The PEA outlines a phased development plan beginning with open pit mining of near surface mineralization followed by underground mining. The Project has been evaluated at a life of mine (“LoM”) average of 2,000 tonnes per day (“t/d”) of Run of Mine (“ROM”) and demonstrates strong economics using a long-term gold price of US$3,500/oz (the “Base Case”), and enhanced economics using a long-term gold price of US$4,500/oz (the “Upside Case”). Readers are cautioned that at this time no production decision in respect of the Project has been made. Any such decision will be dependent on further exploration and the preparation of a feasibility study which has not been completed, as well as other factors.

The PEA is supported by an updated mineral resource estimate (“2026 MRE”), which resulted in a 48% increase in indicated ounces of gold (compared to the 2024 MRE announced on September 4, 2024), showing improved confidence in the estimation upon which the PEA is based. The 2026 MRE is inclusive of an open pit- and underground mineral resource, prepared by WSP Canada Inc. (“WSP”).

Michael Michaud, President and CEO of RPX Gold commented: “The PEA marks a significant milestone for RPX Gold, outlining an expedited, phased development plan, transitioning from open pit to underground mining, with a low-capital path to the first stage of gold production. This mining scenario leverages existing infrastructure and nearby milling capacity that potentially eliminates the need for a mill or tailings facility, streamlining both permitting and construction. The PEA validates the Wawa Gold Project as a highly attractive development opportunity with substantial exploration upside. In the event a production decision is made, the low risk, staged development approach provides an opportunity to generate cash flow from the initial open pits to be used to further explore and develop the larger mineral resource.”

Project Economics

The financial highlights of the Wawa Gold Project are presented in Table 01.

Table-01: Financial Highlights

|

PEA Base Case |

Alternate Upside Pricing Case |

Gold Price – US$ |

$3,500 |

$4,500 |

Exchange Rate – C$/US$ |

1.35 |

1.35 |

Life of Mine - years |

9 |

9 |

|

All amounts in million C$ unless otherwise specified |

|

Average Annual After -Tax Free Cash Flow1 |

$85 |

$145 |

Pre-Tax Net Present Value (5% discount rate) |

$789 |

$1,401 |

After-Tax Net Present Value (5% discount rate) |

$523 |

$935 |

Internal rate of return (after-tax) |

99.7% |

181% |

Payback (after-tax) |

0.9 years |

0.5 years |

Capital Expenditure (Initial) |

$51 |

$51 |

Capital Expenditure (Sustaining) |

$235 |

$235 |

AISC (US$ per ounce)1 |

US$2,149 |

US$2,169 |

|

||

NOTES 1. LoM Cash costs per ounce of gold, all-in sustaining cost (“AISC”) per ounce of gold and free cash flow are non-GAAP measures or ratios. These measures have no standardized meaning under IFRS and may not be comparable to similar measures used by other issuers. Refer to the “Non-GAAP Financial Measures” section of this news release for more information, including a detailed description of these measures. 2. Reference date of the economic analysis is the production decision on the Project. The analysis assumes that no initial capital is spent in advance of this decision, which has not been made as of the date hereof. |

||

|

||

Production Highlights

The production highlights of the Wawa Gold Project are presented in Table 02.

Table-02: Production Highlights

Units |

Open Pit Years 1-3 |

Underground Years 3-9 |

|

Operating Units |

|

|

|

Material Processed (LoM) |

Mt |

2.1 |

4.5 |

Material Processed, Annual average3 |

Mt/y |

0.70 |

0.73 |

Gold Grade (LoM average) |

g/t Au |

2.4 |

3.6 |

Gold Recovery (LoM average) |

% |

88 |

88 |

Gold Production, Annual average3 |

koz Au |

48 |

74 |

Strip Ratio |

w:o |

10.6 |

- |

| Operating Costs | |||

| Mining | C$/t processed |

$66 |

$124 |

| Material Transport and Processing | C$/t processed |

$96 |

$96 |

| General and Administrative | C$/t processed |

$15 |

$15 |

| Royalties1,2 | C$/t processed |

$9 |

$9 |

NOTES

|

|||

Cautionary statement: Readers are cautioned that a PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would be enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. In addition, the assumption that toll milling will be utilized for processing the material requires agreement with a third-party, which has not been obtained.

The Base Case free cash flow (after-tax) and cumulative cash flow (after-tax) profile is shown in Figure 01, which illustrates the impact of capital expenditures on these parameters.

Economic Sensitivities

A sensitivity analysis was carried out, using the Base Case as a starting point, to assess the impact of changes in the price of gold, total capital expenditures (“Capex”) and operating expenditures (“Opex”) on the Project’s net present value (“NPV”) at a 5% discount rate and internal rate of return (“IRR”). The impact of each variable is examined individually with an interval of ±30% and increments of 15% applied. The after-tax results of the sensitivity analysis are shown in Figure 02 and Figure 03. The Project is sensitive to the gold price, with lower sensitivities observed to changes in Capex and Opex.

The sensitivities of the key after-tax economic metrics of the Project were also evaluated at specific gold prices. The results of this analysis are shown in Table 03 with the Base Case highlighted.

Table-03: After-Tax Sensitivity of Economic Parameters to Gold Price

Gold Price |

US$/oz |

2,450 (Base -30%) |

2,975 (Base -15%) |

3,500 (Base) |

4,025 (Base +15%) |

4,550 (Base +30%) |

NPV @ 5% |

C$M |

$86 |

$305 |

$523 |

$739 |

$955 |

IRR |

% |

19% |

58% |

100% |

143% |

185% |

Payback Period |

years |

5.5 |

3.2 |

0.9 |

0.7 |

0.5 |

Development Strategy and Capital Discipline

The PEA was deliberately designed around a capital efficient, high-margin development strategy intended to generate early free cash flow, reduce execution risk, and position the Project to become self-sustaining at an early stage of development.

The mine plan prioritizes easily accessible near-surface mineralization in the early years using an elevated cut-off grade strategy, followed by underground production, while leveraging existing regional infrastructure and toll milling potential. This approach significantly reduces upfront capital requirements by avoiding the construction of a standalone processing facility, resulting in an initial Capex of approximately $51 million, which is materially lower than comparable projects.

With a strong projected cash flow profile with C$303 million cumulative after-tax cash flow net of capital expenditures in the first 5 years of production, rapid payback, and high internal rates of return, the Project is expected to fund ongoing underground development, exploration, and future optimization to reduce reliance on repeated equity financings and thus, shareholder dilution. The Project retains flexibility to scale operations as market conditions permit. Additionally, the Company has available up to C$69 million in tax pool balances that are not reflected in the financial model for the Project.

Importantly, once the Project has achieved steady-state cash flow, the PEA mine plan maximizes the value of the existing mineral resource while preserving substantial upside for future expansion with its demonstrated nearby exploration potential. This phased strategy provides RPX Gold with a clear pathway from development to production while maintaining financial discipline and long-term optionality.

Mineral Resource Estimate

The PEA is supported by the 2026 MRE as presented in Table 04. The 2026 MRE shows a quantity of Indicated mineral resources of 1,244,000 ounces, representing an increase of more than 400,000 ounces (from 842,000 ounces to 1,244,000 ounces), or 48% from the 2024 MRE, while the overall size of the mineral resource remains comparable to the 2024 MRE. This demonstrates a marked improvement in confidence in the mineral resource model supporting the PEA.

The 2026 MRE continues to refer to a small portion of the Company’s land holdings. Numerous historic zones and high priority targets are included in the Wawa Gold Project property and have potential to expand the mineral resource. In both the Jubilee and the Minto deposits, the mineral resource remains open along strike and down-dip.

The 2024 MRE and the 2026 MRE were derived using a 3D block modelling approach, based on Inverse Distance Cubed (ID3) grade interpolation and reported from grade cut-offs and constraining volumes for open-pit (OP) and underground (UG) mining.

Mineral resources are not mineral reserves, and do not demonstrate economic viability. There is no certainty that all, or any parts, of this mineral resource that are the subject of this press release will be converted into mineral reserves. Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves.

Table-04: 2026 Mineral Resource Estimate for the Wawa Gold Project

(Effective Date December 8, 2025)

Category |

Resource |

Tonnes |

Au (g/t) |

Au (oz) |

Indicated |

Open Pit |

22,378,000 |

1.65 |

1,190,000 |

Indicated |

Underground |

531,000 |

3.16 |

54,000 |

Total Indicated |

|

22,909,000 |

1.69 |

1,244,000 |

Inferred |

Open Pit |

7,534,000 |

1.24 |

300,000 |

Inferred |

Underground |

2,417,000 |

2.69 |

209,000 |

Total Inferred |

|

9,951,000 |

1.59 |

509,000 |

| Notes: | |

1) |

The 2026 MRE has been reported in-situ and has been prepared in accordance with the CIM Standards (2014) and follows Best Practices outlined by the CIM (2019). |

2) |

Mineral resources that are not mineral reserves do not have demonstrated economic viability. There are no mineral reserves for the Wawa Gold Project. |

3) |

The QP (for purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101")) for the 2026 MRE is Brian Thomas, P.Geo., an employee of WSP and is "independent" of the Company within the meaning of Item 1.5 of NI 43-101. |

4) |

The effective date of the 2026 MRE is December 8, 2025. |

5) |

A minimum thickness of 3 metres was used when interpreting the mineralized bodies. |

6) |

The 2026 MRE is based on sub-blocked models with a main block size of 3 metres x 3 metres x 3 metres. |

7) |

The open pit-constrained mineral resources are reported at a 0.4 g/t Au cut-off grade considering an Operating Expense (“Opex”) of C$28.00/t ($4.00/t mining, $19.00/t processing, $5.00/t G&A) |

8) |

The underground constrained mineral resources are reported at a 1.5 g/t Au cut-off and a minimum of 2,000 t of contiguous material contained within a 1.40 g/t grade envelope. The 1.5 g/t cut-off assumes underground long hole mining with an Opex of C$144.00/t ($120.00/t mining, $19.00/t milling, $5.00/t G&A). |

9) |

A bulk density factor of 2.77 tonnes per cubic metre (t/m3) was applied for the 2026 MRE. |

10) |

A gold price of C$3,864 (US$2,800) per ounce as used, and a C$/US$ exchange rate of 1.38. |

11) |

Mill recovery of 87% was assumed. |

12) |

Royalty of 2.0% (reduced from 3.5% assuming expected re-purchasing of 1.5% of NSR from previous joint venture partner for C$1.75 million. Franco-Nevada holds an option to purchase additional royalty of 0.5% upon completion of feasibility study). Neither the proceeds to purchase this potential additional royalty nor the 0.5% has been included in the PEA. |

13) |

Rounding may result in apparent summation differences between tonnes, grade, and metal content. |

Mining

The mining methods used for the PEA are conventional open pit mining using truck and shovel followed by underground mining using long hole stoping. The mining schedule assumes one year of pre-production development for the open pits, followed by open pit mining during Years 1 to 3 from a north pit and a south pit, with underground development beginning in Year 2 and underground mining commencing in Year 3 (Figures 04 and 05). The stripping ratio for the open pits is approximately 10:1 given the elevated cut-off grade (0.83 g/t Au) for transporting and processing material at a toll mill. Additionally, wider ramps were designed to allow for larger haul trucks to ensure the 2,000 tonne per day production rate. The lower grade material below the cut-off grade (based on mining and on-site processing costs) will be stockpiled for potential processing in a possible on-site mill in the future, as economics allow.

The main part of the underground mine will be accessed from three portals; two located within the south pit and one within the north pit. Contract mining is assumed to be utilized for both the open pit and underground operations. Therefore, no mining equipment capital costs have been included, as contractor-supplied equipment is incorporated into operating costs over the life of mine. The Capex includes initial capital provisions for mining services, buildings, maintenance facilities, and supporting infrastructure.

Approximately 63% of the ounces in the open pits and 86% of the ounces in the underground mine plan considered in the PEA are in the indicated category, outlining a clear path forward for a drill program required to complete the conversion of inferred ounces (currently included in the mine plan) to indicated in preparation for a pre-feasibility study (“PFS”).

Processing

The gold production profile by year is shown in Figure 06.

The ROM material stockpile will be primary crushed and sampled on site using mobile equipment and placed in a secondary stockpile area for further downstream processing. All crushed material will be transported by highway truck to the selected off-site toll milling facility for processing to produce gold doré bars. Potential toll milling facilities within 150 km are shown in Figure 07). It is assumed that the selected toll milling facility will process material from the Project in the same year as it is mined. There are no current agreements in place with potential toll milling facilities for the Project.

Metallurgical test work completed in 2019 at McClelland Labs Inc. in Reno, NV and at SGS-Lakefield (SGS) in 2025 supports the applicability of conventional cyanidation recovery on Wawa Gold Project mineralogy at a grind size of 80% passing 75 µm. This processing would be deemed conventional and readily processed at various regional mill sites.

For assumed average head grade of 3.2 g/t Au, the modeled gold extraction over a range in arsenic and sulphide contents is estimated at 88% based on test work completed.

Infrastructure

The infrastructure scope includes the primary on-site facilities and supporting infrastructure required to sustain both open pit and underground mining operations (Figure 08). This includes essential site access roads, operational buildings, water management systems, power and utilities, and waste handling infrastructure. Allowance for site access roads is also incorporated, reflecting the development and improvement of road infrastructure required to provide reliable access to the mine site and support the consistent transport of personnel, supplies, and mined material.

The infrastructure scope in the PEA provides for key operational and support facilities required on site, including maintenance, administrative, and service-related infrastructure necessary for day-to-day operations, as well as power transmission and distribution facilities. The PEA also includes allowances for waste management infrastructure to support the safe handling, storage, and management of mine waste materials throughout the life of mine. Allowance for a water treatment facility has been included to manage site water discharge and ensure compliance with applicable environmental regulations and water quality standards. Figure 08 shows the general site plan.

Initial and Sustaining Capital Cost Estimates

The total LOM Capex for the PEA over the 9-year mine life is broken down into Initial Capital and Sustaining Capital Costs (Table 05).

The initial capital cost covers all upfront infrastructure required for mining (excluding mining fleet), crushing, power line, utilities and infrastructure.

The sustaining capital cost schedule (Figure 09) is primarily driven by underground mine development and sustaining underground infrastructure. Sustaining capital costs for underground mine development in Year 2 enable the Project’s transition from open pit mining to underground production. This represents the capital required to initiate underground access and infrastructure in preparation for underground production anticipated in Year 3. The sustaining capital costs across Years 3 through 9 represent ongoing underground development required to support continued underground production. Sustaining capital costs ensure ongoing mine development required to access production stopes, maintain underground infrastructure, and support long-term operations.

The Capex conforms to Class 5 guidelines established by the Association for the Advancement of Cost Engineering International (AACE International).

Table-05: Total Capital Costs

Item |

Cost Estimate1 |

(C$M) |

|

Initial Capital Costs |

|

Mining |

$15.3 |

Processing |

$7.6 |

Power & Utilities |

$1.0 |

Infrastructure |

$14.2 |

Contingency |

$11.4 |

Royalty Buyback |

$1.8 |

Total Initial Capital1 |

$51.2 |

Sustaining and Closure Capital Costs |

|

Underground, Development |

$61.8 |

Underground, Sustaining |

$151.4 |

Exploration |

$6.5 |

Closure and Reclamation |

$15.7 |

Total Sustaining and Closure Capital Costs1 |

$235.4 |

|

|

Total Capital Costs1 |

$286.6 |

1. Amounts may not add up precisely due to rounding |

|

Permitting and Community Engagement

Baseline environmental studies are underway and early engagement with indigenous communities and local stakeholders has commenced. The phased development approach reduces permitting complexity and the Project’s environmental footprint.

Next Steps

- Advance toll milling discussions to a Letter of Intent

- Continue resource expansion and drilling

- Conduct additional metallurgical test work

- Advance Project towards a PFS

- Continue Baseline studies, and permitting efforts

- Continue Indigenous consultation and discussions

- Source contract mining and highway trucking suppliers

Qualified Persons

The technical information in this news release has been reviewed and approved by qualified persons as defined under NI 43-101. Full details will be provided in the associated NI 43-101 Technical Report.

- Syed Saad Mohsin Ali, P. Eng., DRA Americas Inc.

- Alex Duggan, P. Eng., DRA Americas Inc.

- Dave Frost, FAusIMM, DRA Americas Inc.

- Nigel Fung, P. Eng., DRA Americas Inc.

- André-François Gravel, P. Eng., DRA Americas Inc.

- Jean-François Montreuil, P.Geo., RPX Gold Inc.

- Brian Thomas, P. Geo., WSP Canada inc.

- Garth Wilcox, P. Eng., DRA Americas Inc.

Webcast Details

Management will host a webcast and conference call to discuss the results of the PEA on Thursday February 19, 2026, at 10:00 am ET. Please refer to the details below to join the conference call or the webcast. A copy of the conference call will be posted on the website and available for one month from the date of the call.

CONFERENCE CALL NUMBER

Toll Free North America: 1-844-763-8274

International Toll Dial-In Number: +1-647-361-0247

WEBINAR LINK

https://event.choruscall.com/mediaframe/webcast.html?webcastid=mMv6SUJq

If you would like to submit questions ahead of time, please send an email to mgrigo@rpxgold.com, with the subject “PEA Question”.

A replay of the conference call will be available on the Company’s website.

About RPX Gold Inc.

RPX Gold Inc. (formerly Red Pine Exploration Inc.) is a Toronto-based gold company transitioning from exploration to development. The Company's shares trade on the TSX Venture Exchange under the symbol "RPX" and on the OTCQB Markets under the symbol “RDEXF”.

The Company’s flagship asset, the Wawa Gold Project, is located in northwestern Ontario, in the Michipicoten Greenstone Belt of Ontario, adjacent to several established gold-producing operations, including those operated by Wesdome Gold Mines Ltd., Alamos Gold Inc., and Hemlo Mining Corp. The Wawa Gold Project also benefits from strong infrastructure and excess regional mill capacity.

The property currently hosts a National Instrument 43-101 compliant resource from two mineral deposits, namely the Jubilee Shear and the Minto Mine. The mineral resource includes an indicated mineral resource of 22.909 million (“M”) tonnes grading 1.69 grams per tonne gold (“g/t Au”) containing 1,244,000 ounces of gold and an inferred mineral resource of 9.951 M tonnes grading 1.59 g/t Au containing 509,000 ounces of gold, with both open pit and underground mining potential. Gold mineralization extends to surface on a historic mining property, which supports a staged development strategy.

RPX Gold is evaluating Phase 1 open-pit operations designed to generate early cash flow and help self-fund advancement of the Wawa Gold Project as the Project transitions to an underground operation. The phased approach is aimed at de-risking development, accelerating time to revenue, and minimizing shareholder dilution.

For material information about the Company, visit www.redpineexp.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains statements which constitute “forward-looking information” within the meaning of applicable securities laws, including statements regarding the plans, intentions, beliefs and current expectations of the Company with respect to future business activities and operating performance.

Forward-looking information is often identified by the words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or similar expressions. Forward-looking information contained in this news release includes, but may not be limited to: statements regarding the ability to execute the Company’s plans relating to the Wawa Gold Project as set out in the PEA; the ability to realize on the mineral resource estimates or delineating additional mineral resources; generating cash flow for further exploration and development of a larger mineral resource; the Project funding ongoing underground development, exploration, and future optimization to minimize reliance on repeated equity financings and shareholder dilution; the ability to negotiate and execute toll milling arrangements on satisfactory terms or at all; continuing collaboration with First Nations partners as part of an inclusive and responsible development process; and advancing the PFS. Investors are cautioned that forward-looking information is not based on historical facts but instead reflects management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Such opinions, assumptions and estimates are inherently subject to a variety of risks and uncertainties that could cause actual events or results to differ materially from those projected and undue reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking information are: the Company's expectations in connection with the projects and exploration programs being met, the impact of general business and economic conditions, global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future conditions, fluctuating gold prices, currency exchange rates (such as the Canadian dollar versus the United States Dollar), variations in material grade or recovery rates, changes in accounting policies, changes in the Company's mineral reserves and resources, changes in Project parameters as plans continue to be refined, changes in Project development, construction, production and commissioning time frames, the possibility of Project cost overruns or unanticipated costs and expenses, higher prices for fuel, power, labour and other consumables contributing to higher costs and general risks of the mining industry, failure of plant, equipment or processes to operate as anticipated, unexpected changes in mine life, seasonality and weather, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims, and limitations on insurance.

This information contained in this news release is qualified in its entirety by cautionary statements and risk factor disclosure contained in filings made by the Company, including the Company’s financial statements and related MD&A for the year ended July 31, 2025, and the interim financial report and related MD&A for the period ended October 31, 2025, filed with the securities regulatory authorities in certain provinces of Canada and available at www.sedarplus.ca.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

Non-GAAP Measures

Certain financial measures referred to in this news release are not measures recognized under IFRS and are referred to as non-GAAP financial measures or ratios. These measures have no standardized meaning under IFRS and may not be comparable to similar measures presented by other companies. These measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

The non-GAAP financial measures used in this news release and common to the gold mining industry are defined below:

- Cash cost and cash cost per ounce of gold: Cash cost consists of all production related expenses including mining, material transport, processing, services, royalties, treatment charges, penalties, and other selling costs. Cash cost per ounce of gold is calculated as cash cost divided by payable gold ounces.

- All-in sustaining cost and all-in sustaining cost per ounce of gold: All-in sustaining cost consists of cash cost, plus cash outlays for sustaining capital expenditures, closure capital expenditures, and corporate general and administrative expenses. All-in sustaining cost per ounce of gold is calculated as all-in sustaining cost divided by payable gold ounces.

- Free cash flow: Free cash flow on an after-tax basis is defined as cash provided from operating activities, less cash outlays for sustaining capital expenditures, closure capital expenditures, changes in working capital and applicable taxes.

As the Project is not in production, the QPs do not have historical non-GAAP financial measures nor historical comparable measures under IFRS and therefore the foregoing prospective non-GAAP financial measures or ratios presented may not be reconciled to the nearest comparable measure under IFRS.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260218160367/en/

Michael Michaud, President and Chief Executive Officer, at (416) 364-7024 or mmichaud@rpxgold.com

Or

Manish Grigo, Director of Corporate Development, at (416) 569-3292 or mgrigo@rpxgold.com