AMSTERDAM, May 22, 2025 /PRNewswire/ -- Hassan Badrawi, CEO of OCI Global:

"OCI entered 2025 with positive momentum, following a year marked by significant portfolio changes. In the first quarter, we delivered on key transaction milestones, including the resolution of the previously disclosed dispute with our Natgasoline joint venture partner Proman regarding the sale of OCI Methanol to Methanex, as well as substantial progress on the construction of the Beaumont New Ammonia plant, scheduled for completion later this year. Operationally, our European portfolio performed well during the period, despite planned shutdowns at certain assets.

In line with our approach to disciplined capital returns, OCI distributed USD 1.0 billion to shareholders in May, bringing cumulative distributions to USD 6.4 billion over the past four years. OCI continues to prioritize shareholder value whilst preserving capital allocation flexibility and strategic optionality. Any future extraordinary cash distributions will be determined based on transaction progress, the ongoing strategic review, and Board approval.

As part of our ongoing transformation, OCI also secured a binding support agreement with a large group of bondholders regarding the treatment of the 2033 bonds, pending completion of the Methanol sale. This will facilitate an orderly pay down of OCI's capital structure following the closing of the transaction.

Looking ahead, our main priorities are to complete the construction and handover of Beaumont New Ammonia, and to close the Methanol transaction as planned in Q2 2025. With a simplified corporate structure, a stable balance sheet, and a competitive European nitrogen platform, OCI is well-placed to execute on its current objectives and to support value creation."

Key Financial Highlights

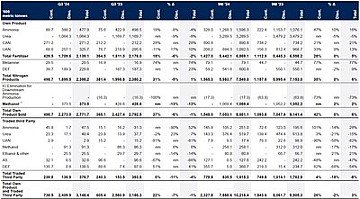

-- Continuing Operations Adjusted EBITDA for Q1 2025 continued to show a

loss, but performance improved over the prior quarter as corporate cost

reduction measures gained traction.

-- The European Nitrogen segment's profitability was challenged during the

quarter by higher gas prices year-on-year and a planned turnaround that

negatively impacted EBITDA margin. Despite these headwinds, the segment

continues to be profitable and is well-positioned to benefit from the

anticipated decrease in European gas prices.

-- OCI has accelerated its efforts to streamline the corporate cost

structure, achieving meaningful progress in aligning the organization to

its post-divestment footprint. The Company remains on track to beat its

previously guided corporate cost target of USD 30 - 40 million on a run

rate basis by the end of 2025.

-- Within Discontinued Operations, OCI Methanol delivered a resilient

financial performance in Q1 2025 notwithstanding a planned turnaround at

the OCI Beaumont plant. Results were supported by elevated methanol

prices and reduced natural gas hedge losses compared to the same period

last year, as well as a record performance at Natgasoline, which

successfully resumed operations at the end of last year.

-- Net cash from Continuing Operations stood at USD 1,033 million as of 31

March 2025 compared to a net cash position of USD 1,371 million as of 31

December 2024.

Key Strategic and Business Highlights

-- The announced sale on 8 September 2024 of OCI's global methanol business

("OCI Methanol") to Methanex Corporation ("Methanex") has been approved

by both companies' boards and is expected to close in Q2 2025, subject

to regulatory approvals and customary conditions. On 14 May 2025, the

European Commission (EC) announced it had approved the acquisition under

the EU Merger Regulation, concluding that the transaction does not raise

competition concerns. In March 2025, OCI secured a favorable and final

resolution of the previously disclosed dispute with Proman regarding

shareholder rights in its Natgasoline joint venture. Following a

Delaware Court of Chancery ruling in OCI's favor and the subsequent

withdrawal of Proman's appeal, OCI's 50% interest in Natgasoline remains

part of the transaction perimeter.

-- Construction of the Beaumont New Ammonia site is well advanced and

nearing completion, with engineering and procurement mostly complete,

and the team currently preparing for commissioning and startup later

this year. The project remains on track in terms of total cash spend,

which stood at USD 1,167 million as of 31 March 2025.

-- OCI made a further extraordinary distribution of approximately USD 1

billion as a repayment of capital or at the election of the shareholder,

from the profit reserve in May 2025, bringing total cumulative

distributions to USD 6.4 billion over the last four years.

-- In April 2025, OCI reached a Support Agreement with a bondholder group

representing over 60% of its USD 600 million 6.700% Notes due 2033,

relating to the treatment of the bonds following contemplated completion

of the announced sale of OCI Methanol. Under the Support Agreement, OCI

will launch a tender offer for the bonds within five business days of

the successful closing of the transaction at 110.75% of par plus accrued

and unpaid interest, with the bondholder group agreeing to support and

tender into such offer. The group also agreed to support proposed

amendments to the bonds, including a redemption right on or after

closing at the same price and a waiver of any alleged defaults or events

of default that may be outstanding under the documentation governing the

bonds.

-- With regards OCI's strategic review, the Company remains actively

engaged in the evaluation of strategic alternatives for its continuing

businesses. Any future decisions will be made in the best interests of

all shareholders.

Continuing and Discontinued Operational Highlights

Continuing Operations, as presented in this trading update, reflect the performance of the European Nitrogen segment. Further to the announcement of the expected divestiture of OCI's equity holdings in OCI Methanol, this segment is classified as Discontinued Operations.

European Nitrogen

-- Own-produced sales were 484 thousand tonnes during the first quarter of

2025, materially unchanged year-on-year and 16% higher

quarter-on-quarter. Despite a planned turnaround of the ammonia line as

well as the UAN and CAN plants during the quarter, overall production

levels were stable year-on-year, supported by the production of new

products including AdBlue and CAN+S. Benchmark prices for nitrates were

higher in Q1 2025 compared to Q1 2024 and showed a sequential

improvement quarter-on-quarter.

-- In February 2025, OCI Nitrogen, Dossche Mills and AGRAVIS announced

major progress in their partnership to scale sustainable wheat

production across Europe. Using low-carbon fertilizers and farmer

incentives, the initiative enabled a tenfold increase in sustainable

wheat harvested in 2024, delivering 14,000 tonnes - enough for

twenty-five million lower-carbon loaves of bread. The partners aim to

triple production in the coming years while maintaining quality and

supporting farming practices.

-- In March 2025, OCI Global partnered with RWZ to supply low-carbon

fertilizers to RWZ and BASF's "KlimaPartner Landwirtschaft" carbon

farming initiative. The collaboration, utilising OCI's low-carbon

nitrogen solutions, supports climate-smart practices across 8,200

hectares of winter wheat and aims to cut CO₂-equivalent emissions per

tonne of yield by 30%, helping future-proof arable farming with

ecological and economic benefits.

-- In April 2025, OCI, alongside Trammo, James Fisher Fendercare and other

partners, successfully completed the Port of Rotterdam's first ammonia

ship-to-ship bunkering pilot, transferring eight hundred cubic meters of

liquid ammonia. The safe execution of this milestone highlights the

strategic value of OCI's ammonia import terminal and distribution

infrastructure in enabling the adoption of clean ammonia as a marine

fuel and supporting the decarbonisation of global shipping.

OCI Methanol

-- Own-produced methanol sales from the methanol business were 233 thousand

tonnes in the first quarter of 2025, 34% lower than Q1 2024 and 7% lower

than Q4 2024. Volumes were impacted by a planned turnaround at OCI

Beaumont, while Natgasoline ran at a 95% AUR in Q1 2025 following its

successful restart at the end of 2024.

-- Benchmark prices for methanol were materially improved in the quarter

compared to the same period last year. Spot US Gulf Coast methanol

prices averaged USD 370/t in Q1 2025, 17% higher than the USD 317/t

averaged in Q1 2024.

https://mma.prnewswire.com/media/2690897/OCI_Global_1.jpg [https://mma.prnewswire.com/media/2690897/OCI_Global_1.jpg]

https://mma.prnewswire.com/media/2690896/OCI_Global_2.jpg [https://mma.prnewswire.com/media/2690896/OCI_Global_2.jpg]

Notes

This report contains unaudited first quarter highlights of OCI Global ('OCI,' 'the Group' or 'the Company'), a public limited liability company incorporated under Dutch law, with its head office located at Honthorststraat 19, 1071 DC Amsterdam, the Netherlands.

OCI Global is registered in the Dutch commercial register under No. 56821166 dated 2 January 2013. The Group is primarily involved in the production of nitrogen-based fertilizers and industrial chemicals.

Auditor

The reported data in this report have not been audited by an external auditor.

Market Abuse Regulation

This press release contains inside information as meant in clause 7(1) of the Market Abuse Regulation.

About OCI Global

Learn more about OCI at www.oci-global.com [https://oci-global.com/]. You can also follow OCI on LinkedIn. [https://www.linkedin.com/company/ociglobal/mycompany/]

OCI stock symbols: OCI / OCI.NA / OCI.AS

Photo - https://mma.prnewswire.com/media/2690897/OCI_Global_1.jpg [https://mma.prnewswire.com/media/2690897/OCI_Global_1.jpg?p=original]

Photo - https://mma.prnewswire.com/media/2690896/OCI_Global_2.jpg [https://mma.prnewswire.com/media/2690896/OCI_Global_2.jpg?p=original]

View original content:https://www.prnewswire.co.uk/news-releases/oci-global-q1-2025-trading-update-302461741.html [https://www.prnewswire.co.uk/news-releases/oci-global-q1-2025-trading-update-302461741.html]

Photo: https://mma.prnewswire.com/media/2690897/OCI_Global_1.jpghttps://mma.prnewswire.com/media/2690896/OCI_Global_2.jpg OCI Global

CONTACT: OCI Global Investor Relations - Sarah Rajani, CFA,

Sarah.Rajani@oci-global.com